taxing unrealized gains yellen

United States President Joe Bidens Treasury secretary nominee Janet Yellen has once again become a topic of discussion in the Cryptoverse - this time over her comments suggesting she may look to tax of unrealized gains. A Texas resident would see the following taxes.

Democrats Terrible Idea Taxing Profits That Don T Exist

If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed 50000 in unrealized.

. Treasury Secretary nominee Janet. Capital gains tax is a tax on the profit that investors realize on the sale. The impacted assets include stocks bonds real estate and art.

This tax on money not yet earned or maybe never earned at all is drawing fierce resistance from many. National Investment Income Tax 38. The first income tax enacted after ratification of the Sixteenth Amendment in 1913 had seven tax brackets with rates from 1 on income over 3000 83972 in current dollars to 7 on income.

For example perhaps you purchased a house at 300000 and sold it for 350000. According to Yellen the funds collected would help finance things related to climate and social change. Lawmakers are considering taxing unrealized capital gains.

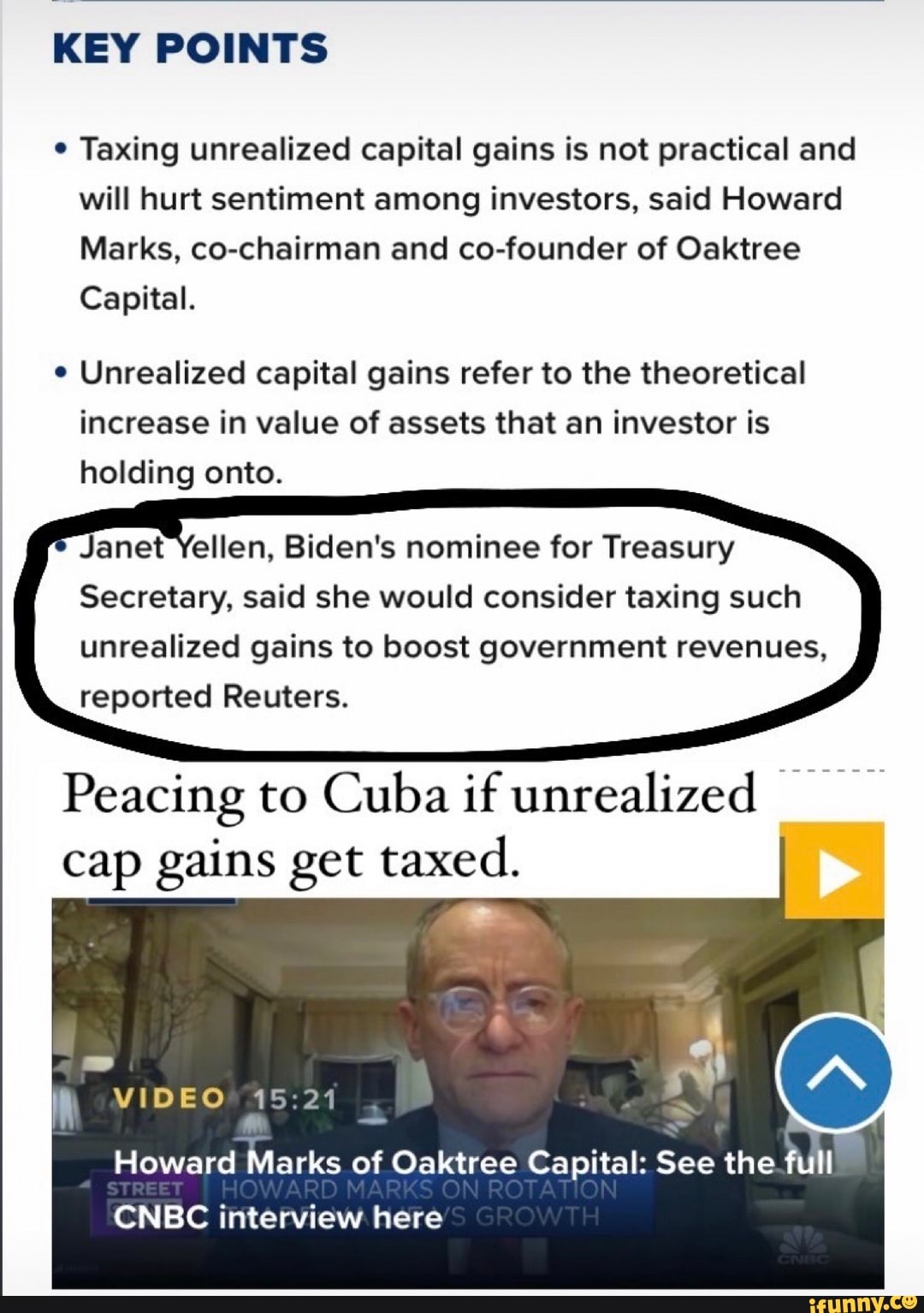

The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income. And this has led some to question if the US is demonstrating a sign of what is to come in other countries that are printing fiat money at an. Billionaire investor Howard Marks was highly critical of Biden Treasury Secretary nominee Janet Yellen for saying shed consider taxing unrealized capital gains.

Unrealized gains could be very important if you invest in funds however. Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Billionaire Investor fires back after Yellen says shed consider taxing unrealized capital gains.

Yellen told Jake Tapper I think whats under consideration is a proposal that Senator Wyden and the Senate Finance Committee have been looking at that would impose a tax on unrealized. Its foolish to think this stops with the rich. Yellen may say this is about billionaires but lets not forget that when income tax was started in 1913 a family making the modern equivalent of 80000 a year was only taxed 1 with a cap of 6 for those richer.

At a time when there. Yellen Describes How Proposed Billionaire Tax Would Work. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. And this tax only applied to 3 of the population. An unrealized capital gains tax would violate this long-standing principle.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. It is the theoretical profit existent on paper. Janet Yellen Bidens nominee for Treasury Secretary said she would consider taxing such unrealized gains to boost government revenues reported Reuters.

With estimates of close to 9 trillion in assets being passed on by 2030 and a projected 68 trillion being transferred in the next 30 years taxing those assets at original cost basis would generate trillions in tax revenue and force heirs to sell family businesses and family farms due to not being able to pay the inheritance taxes. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. Profits or so-called capital gains on investment income are taxed at a lower rate than regular income from 15 percent to around 28 percent but only if.

Yellen waived off the question saying that was one of many ways of dealing. Texas long term capital gain rate 0. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

Treasury secretary Janet Yellen told CNNs State of the Union on Sunday that US. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. Ron Wyden D-Oregon would impose an annual tax on unrealized capital gains on liquid assets.

Do you pay taxes on unrealized gains. The Biden administration is looking to raise its tax revenue to fund a 35 trillion spending plan over ten years. Lawmakers are considering taxing unrealized capital gains.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Marks who is co-chairman and co-founder of Oaktree Capital said I.

Government coffers during a virtual conference hosted by The New York Times. Secretary of the Treasury Janet Yellen speaks during a daily news briefing at the White House. Even though there is little to no chance of it passing through Congress and if it did would then be struck down by the courts that its even being kicked around shows the power of the New Left on the moral bent of the party.

When you buy shares of a mutual fund or ETF exchange-traded fund youre also buying any unrealized gains it hasand youll be subject to their eventual taxation. Yellen had first proposed the tax on unrealised capital gains in. Senator Pat Toomey R-Penn came closest to a pointed question asking Yellen about the Biden administrations plans to tax unrealized capital gains.

Total long term capital gain rate 434. You wont pay any taxes until you sell the share.

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Yellen About Tax On Unrealized Gains

Oaktree Memes Best Collection Of Funny Oaktree Pictures On Ifunny

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Lorde Edge And Unrealized Gains Tax No Safe Bets

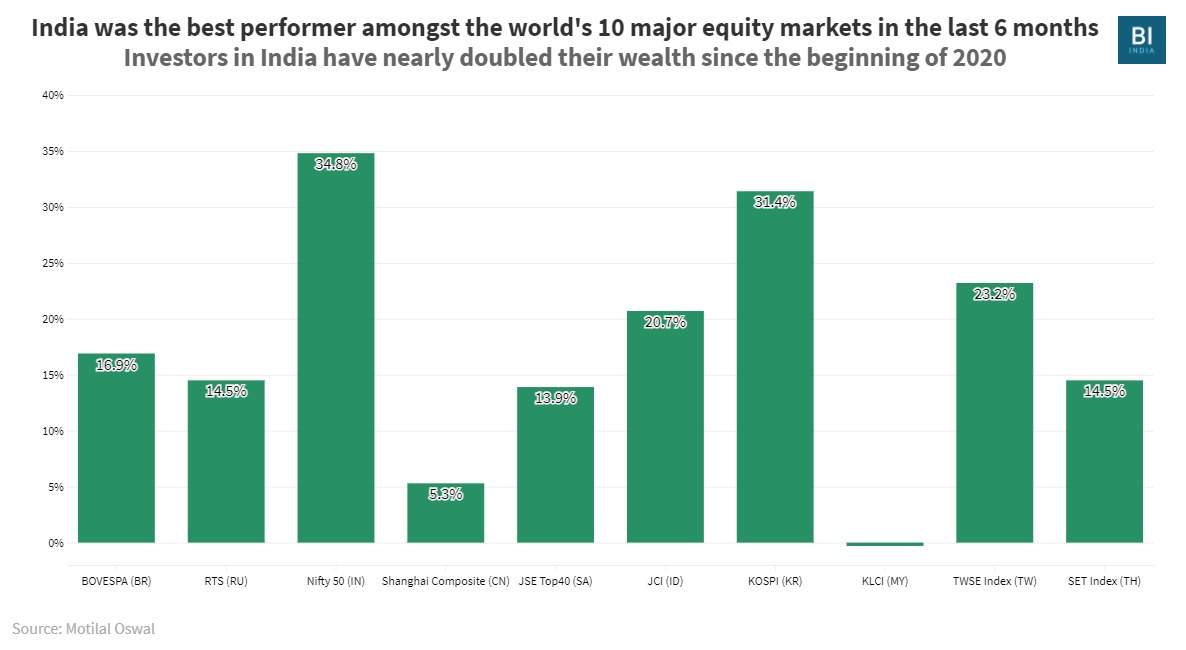

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Taxing Unrealized Capital Gains A Truly Bad Idea The Musings Of The Big Red Car

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Biden S Cabinet Janet Yellen Considers Taxing Unrealized Gains R Accounting

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets